The future of automotive retail

Simon Porri

·

7 minute read

Simon Porri

·

7 minute read

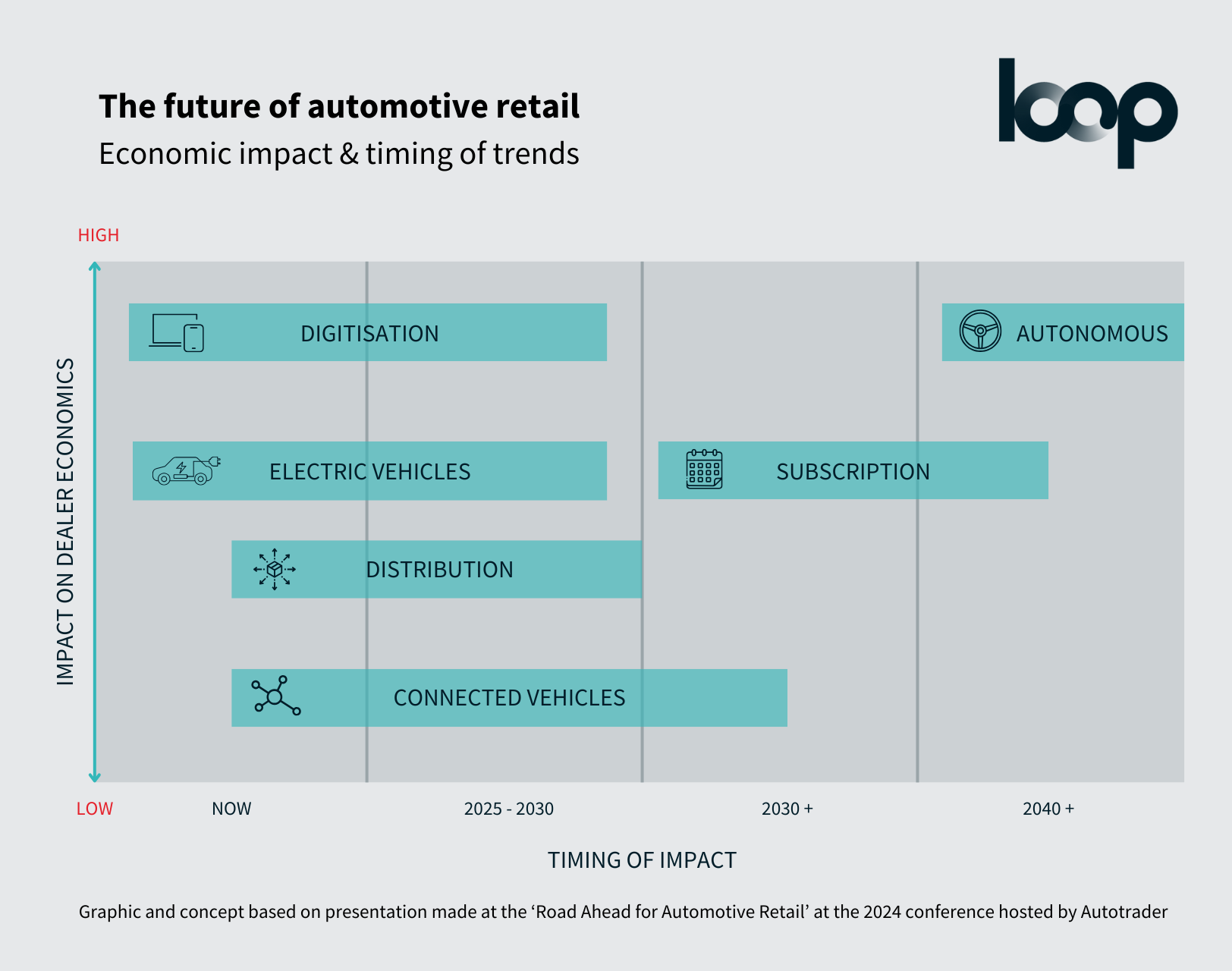

After years of growth driven by advancements such as alternative fuels, and the popularity of both personal contract purchases (PCP) and personal contract hires (PCH), COVID-19 transformed the automotive retail industry almost overnight. Technological advancements have since accelerated, leading to the adoption of the acronym CASE - Connected, Autonomous, Shared and Electrified. Recently, this has evolved into CASEDD, incorporating digitisation and distribution.

Despite a post-pandemic boost in 2023, Forbes warns of declining profits for European OEMs in 2024 and even greater challenges in 2025.1 We will witness popularity for pay-per-use mobility, offering consumers access to shared vehicles. PwC forecasts that

“the total number of vehicles in use in Europe will peak at 308 million in 2025 and drop to 294 million units by 2030”. 2

With this in mind, the market is rapidly shifting away from traditional car dealerships.

What defines the future of auto retailing?

The role of digital transformation in automotive

Moving forward, an awareness of how automotive retail needs to change and how to implement those changes on the ground will be crucial. Business Intelligence (BI) tools can help by analysing performance and considering evolving consumer expectations. We’re witnessing a fundamental digital transformation in automotive, which supports the ongoing growth and changes reshaping the industry.

But, what exactly is the future of automotive retail, and how can retailers adapt to stay ahead of the curve?

This article explores six key trends reshaping automotive retail and provides actionable strategies for retailers to adapt and thrive in this evolving landscape.

Key trends shaping the future of automotive retail

Trend #1: The impact of technology & rise of the electric vehicle

Technological innovation and the automotive industry have always been a match made in heaven. Electric mobility is set to continue growing off the back of increasing environmental concerns. In the UK, for instance, there are expected to be 300,000 public chargers available by 20303 and the ZEV mandate dictates that 22% of new cars sold in 2024 should be pure electric. These efforts have come alongside the launch of more affordable EVs to provide choice to consumers who were previously unable to access these options, and have significantly upped the pressure to turn talk of autonomous vehicles into a reality industry-wide moving forward.

Strategies to help

Understanding technological advancements and how consumers feel about them, is the only way for retailers to engage with evolving trends. For example, retailers need to develop expertise in EV technology quickly. Consumers now demand more from their automotive buying journeys, seeking greater convenience and integrated, customised experiences. These expectations are reshaping the breadth of products and services offered by manufacturers, pushing them to innovate and adapt.

Luckily, technological advancements have merged with a growing online landscape to create an age of big data where such information is there for the taking. By simplifying data analytics in line with KPIs and wider business focuses, retailer management tools that take technology-driven insights into account are poised to provide a unique perspective on the automotive industry’s future. This approach also makes it possible to recognise both strong and weak areas of technological implementation, allowing for important improvements to be made.

Retailers and manufacturers must rise to the challenge, leveraging these insights to not only meet but exceed consumer expectations, crafting journeys that are as seamless and personalised as they are innovative.

Trend #2: Omnichannel experiences surpassing online approach

Predictions have been made about the ‘death of the in-person dealership’ since the internet’s launch in the early 1990s, and with more and more vehicle sales taking place online, that prediction seemed to be closer than ever to coming true. However, the appetite for online first has declined in favour of an omnichannel approach. Customers are now expecting both an excellent and convenient digital experience including virtual showrooms, followed by a positive forecourt experience provided by the dealer. Although customers are coming to retailers having visited online car sales platforms, they still want the reassurance of a test drive, vehicle inspection and knowledge of a salesperson, especially if looking to move to an EV. The online element is so important to set a good first impression, as well as the fact:

“Millenials and Generation Z are more inclined to remotely interact with sales personnel and ultimately buy online. Such generations will represent the majority of buyers by 2025.”4

Strategies to help

Studies have proven that 70% of buyers continue to see physical dealerships as a major sales touchpoint.5 This means that, despite the strength and popularity of online retail, an omnichannel approach, rather than going completely digital, is likely to be most effective going forward. Retailers facing this moment of change, therefore, need to consider how best to merge online and in-person capabilities to complement each other rather than cause unwanted complexity. BI solutions that merge data sources to produce valuable insights and transferable goals are the best way to make that happen, providing simplified reporting capabilities and ensuring teams are better able to continue operating as a cohesive whole. By utilising data and technology, customer pain points in the car buying journey can be constantly monitored and alleviated. This must be supported by a high level of customer service for success.

In this rapidly evolving landscape, the synergy between online and offline strategies allows businesses to reach customers wherever they are, catering to diverse preferences and needs. As a result, manufacturers and retailers alike can strengthen their market presence and drive sustainable growth by harnessing the full potential of both digital and physical touchpoints.

Trend #3: Consolidation of dealer networks

With dealership numbers more than halving between 1976 and 2016, the showroom was in slow decline long before COVID-19. The pandemic accelerated this trend, especially in the franchise sector. Alongside soaring online sales, this heralds a future that looks set to revolve around the most lucrative outlets in a franchise, and the continued consolidation that furthers their profitability.

Strategies to help

To avoid the negatives that come with consolidation, it’s essential to understand where money-making power lies, and how to consolidate processes around that strength to ultimately turn this potential pitfall into a competitive advantage. In this sense, information is very much power, and action-oriented BI systems that facilitate franchise-wide data analysis and goal setting are best for ensuring an in-depth understanding of where profitability is at its highest, and where struggles lie with the help of key focuses that include:

- Consolidated, trackable KPIs

- Visible action planning

- Franchise-wide performance scorecards

- Automatic score calculations

- Reporting tools

Within an automotive-specific context, these can accelerate dealer network consolidation by helping to identify sites with the best performance to allow increased focus in order to maximise returns, whilst closing down sites performing below expectations. OEMs are future-proofing their software capabilities to strengthen their ability to capture and analyse data and monitor network performance, meaning retailers will benefit from clearer strategic guidance to help deliver the brand’s goals.

Trend #4: Evolving automotive retail strategies

In recent years there’s been talk of OEMs adopting an agency model, and indeed some have taken that approach or at least dipped their toe in the water. However, a third of top OEMs have ruled it out for now6 and a more hybrid approach is being considered by many. What’s becoming apparent is that the hybrid model differs from one OEM to another and there is no one size fits all solution.

Strategies to help

With this uncertainty hanging over retailers it’s clear that OEMs need to change their distribution methods to remain competitive, so acknowledging that there’s a need to adapt is a good first step. Key actions include:

- Staying up to date with industry developments

- Leveraging artificial intelligence (AI), machine-learning (ML) and cloud services to improve processes

- Enhance customer experience, from making service appointments, handling warranty issues, expanding services and product offering to giving individuals a bespoke buying experience

- Ensure your online presence is sophisticated and customer-centric

- Developing partnerships with new brands while strengthening existing ones

Trend #5: New revenue streams

Digitisation and shared access to vehicles have reshaped the automotive retail landscape, with calls for convenient affordability also making it imperative that retailers facilitate entirely new streams of revenue. Service-based models like Transport-as-a-Service (TaaS), are especially pushing private ownership aside and driving dealerships towards Netflix-style Car-as-a-Service (CaaS) models that offer month-by-month car lease contracts. Further innovative revenue outlets also centralise ease, and include cutting-edge solutions like Carvana’s first fully-automated vending machine, which has already seen the company spending just 10% of what a standard dealership would while selling three times the amount of vehicles, and highlights just how lucrative innovative revenue could be to the entire industry in the future.7 Retailers are likely to benefit from the rapid emergence of Chinese brands, who are seeking partnerships with dealerships to raise brand awareness and expand quickly.

Strategies to help

Successfully breaking into often expensive new revenue streams relies on a company’s ability to understand profitability and remain realistic about investment. Questions need to be asked about potential returns, longevity, and market sway. By collecting quality data across consumer sets, and utilising BI software that tracks behaviours and preferences that are able to address these pain points, it’s easier for retailers to not only distinguish trends from fads, but to also set trackable goals that contextualise and justify spending in these areas. As highlighted previously, keep abreast of industry developments, listen to your customers and look to build relationships with new entrants to the market.

Trend #6: Environmental regulations

Declining emissions during lockdown restrictions have furthered a growing environmental focus that has been gaining traction since the conception of EVs and the fallout of environmental failures. For automotive retailers especially, a failure to adhere to or foresee environmental regulations leaves the doors open for reputational damage that impacts sales and creates higher price points, as well as hefty fines for not meeting Net Zero targets. Success in the face of these challenges relies not only on the facilitation of affordable EVs, but also on the furthering of industry-defining environmental initiatives including:

- Car shares

- Recycling campaigns

- Reassessment of end-of-life disposal

- Sustainable research and development

Strategies to help

Sustainability strategies should be implemented at every stage of the sales cycle to address environmental concerns, and BI systems that make it easier to respond to changes in demand and regulation can make that happen. BI tools that allow for impact measurement and sustainability reporting are especially fundamental for driving change off the back of incoming insights. By focusing on non-financial KPIs within these dashboards, retailers can also ensure that they’re able to assess activities and relationships, considering how they fit within existing environmental objectives, and also how they can adapt to an ever-changing environmental landscape.

Remain competitive with data-driven insights

Competing in automotive retail is dependent on a dealership’s ability to identify areas for success and improvement. Readily available data is the key to unlocking this advancement and is very much there for the taking as automotive technology, and wider switches to an omnichannel approach, see the industry joining the big data drive. BI tools that turn that data into actionable outcomes, and enable the improvement of relevant KPIs as a result, are a key factor in both meeting the market where it is, and adapting to the challenges that will continue evolving as the industry moves ever-closer to autonomous vehicles and adaptive revenue streams.

Our retail performance management software is helping automotive retailers to lead the future of automotive retail, through a range of action-oriented focuses that make it possible to assess strengths, weaknesses, and potential areas for improvement in an ever-shifting sales landscape. Centralised insights, collaborative action-planning, and KPI dashboards stand to bring the future of automotive retail directly to your dealership’s door, both now and as we move into a future that remains uncertain.

Editor's note: This article was originally written in 2021 but has been reviewed and updated in 2024.

Footnotes:

- Europe’s Auto Profitability To Slip In 2024, But Watch Out For 2025

- Future of Automotive Retail

- Tenfold expansion in chargepoints by 2030 as government drives EV revolution - GOV.UK

- Future of Automotive Retail

- https://www.autotraderinsight-blog.co.uk/auto-trader-insight-blog/the-key-takeaways-from-the-road-ahead-for-automotive-retail-conference

- https://www.autotraderinsight-blog.co.uk/auto-trader-insight-blog/the-key-takeaways-from-the-road-ahead-for-automotive-retail-conference

- Carvana Car Vending Machine - by Carvana / Core77 Design Awards